Where the techniques of Maths

are explained in simple terms.

Financial Maths - Present values.

Test Yourself 1.

- Algebra & Number

- Calculus

- Financial Maths

- Functions & Quadratics

- Geometry

- Measurement

- Networks & Graphs

- Probability & Statistics

- Trigonometry

- Maths & beyond

- Index

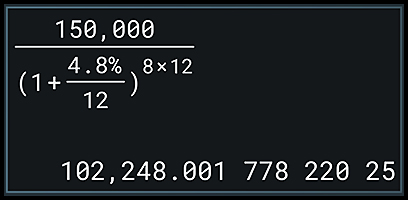

To answer these questions, you will need to use the relationship involving compound interest of:

Future value = Present value × (1 + rate%)no. of periods

| Annual | 1.  |

|||||||||||||||||||||||||||||||||||

2. |

||||||||||||||||||||||||||||||||||||

3.  |

||||||||||||||||||||||||||||||||||||

4.  |

||||||||||||||||||||||||||||||||||||

| Annuity-type questions using Present Value tables. | ||||||||||||||||||||||||||||||||||||

| Present value | 5. Interest rate converts to 1.6% ÷ 2 = 0.8%. Number of periods: 8 × 2 = 16 months. PV Interest Factor (from table): 14.9623 Deposit: $500 × 14.9623 = $7,481. |

|||||||||||||||||||||||||||||||||||

| 6. Interest rate does not need conversion: 2.0%.

Number of periods: 6 years. PV Interest Factor (from table): 5.6014 Deposit: $3,000 × 5.6014 = $16,804. |

||||||||||||||||||||||||||||||||||||

| 7. | ||||||||||||||||||||||||||||||||||||

|

8. Interest rate converts to 12% ÷ 12 = 1.0%.

Number of periods: 3 × 12 = 36 months. PV Interest Factor (from table): 30.1075 Deposit: $250 × 30.1075 = $7.527. |

||||||||||||||||||||||||||||||||||||

| 9. | ||||||||||||||||||||||||||||||||||||

| Monthly | 10. The table below shows present value factors for a number of periods by monthly interest rate.

Use this table to calculate the monthly repayment required for a loan of $15,000 at 6% p.a. which is repayable over 5 years. Answer.M = 15000 ÷ 51.72556= $289.99. |

|||||||||||||||||||||||||||||||||||

| 11. Interest rate converts to 3.6% ÷ 12 = 0.3%.

Number of periods: 4 × 12 = 48 months. PV Interest Factor (from table): 44.6419 20000 = M × 44.6419 ∴ M = $448.00 per month. |

||||||||||||||||||||||||||||||||||||

| 12. Interest rate: 0.1%.

Number of periods: 52 weeks. PV Interest Factor (from table): 50.6465 Present value = 30 × 50.6465 ∴ Possible loan = $1,519. Happy Schoolies Paula!!! |

||||||||||||||||||||||||||||||||||||

13. (i) $2000 × 23.2760 = $46,552. (ii) Investment = $2000 × 15 years = $30,000. (iii) (iv) As time passes, the value of money decreases due to inflation, etc. In this case due to the interest rate. Hence although $30,000 is actually paid, the value of that amont in today's dollar is reduced to $19,424. Interpreting this result another way, we can say that we could invest a single amount now of $19,424 at 6% p.a. and receive $46,552 in 15 years. |

||||||||||||||||||||||||||||||||||||